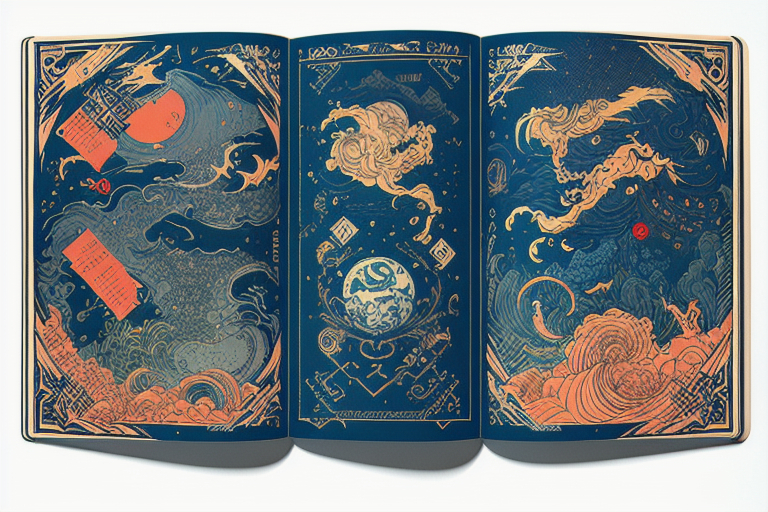

The End of the World Almanac

A handbook of our post-factual future

“Rick has combines unexpected premises with compelling prose to deliver great stories.”

John Ward, Written Ward

By registering you agree to Substack's Terms of Service, our Privacy Policy, and our Information Collection Notice